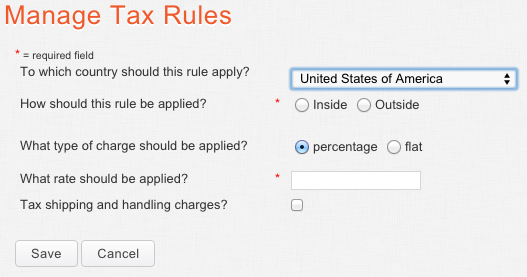

New Tax Rule Setup

The ability to create and manage tax rules gives you the flexibility to have tax charged on orders based on the country, state or zip code of the shipping address.

Creating and editing tax rules can be broken down into two major sections: when to charge tax and how much tax to charge.

1. When to charge tax:

a. By country: You can choose to have the tax rate applied when the shipping address is inside or outside of a particular country. If outside is chosen, then any address outside of that particular country will be charged the tax rate. If inside is chosen, the entire country can be set or a further breakdown of the criteria can be set:

i. By State: A specific state in the United States.

ii. By Zip Code:

· A specific five digit zip code

· One zip code prefix (e.g., 89 matches all ZIP codes starting with 89)

· A range of zip codes (e.g., 894-896)

· Note: You can only enter one zip code, one prefix, or one range per rule. If you need to enter more than one of any, or a combination, you will have to make separate rules.

2. How much to charge:

a. Type of rate: Percentage or a flat rate

b. Specify the tax rate to be applied

c. Choose whether or not to tax shipping and handling charges

Note: If the shipping address meets the criteria for multiple tax rules, then the tax rate for all of those rules will be applied to the order.For example, if there is a tax rule for the state of MN, and another tax rule for zip code 55344, and the state is MN and the zip code is 55344 of the shipping address on the order, then both of the tax rules will be applied to the order.

The ability to create and manage tax rules gives you the flexibility to have tax charged on orders based on the country, state or zip code of the shipping address.

Creating and editing tax rules can be broken down into two major sections: when to charge tax and how much tax to charge.

1. When to charge tax:

a. By country: You can choose to have the tax rate applied when the shipping address is inside or outside of a particular country. If outside is chosen, then any address outside of that particular country will be charged the tax rate. If inside is chosen, the entire country can be set or a further breakdown of the criteria can be set:

i. By State: A specific state in the United States.

ii. By Zip Code:

· A specific five digit zip code

· One zip code prefix (e.g., 89 matches all ZIP codes starting with 89)

· A range of zip codes (e.g., 894-896)

· Note: You can only enter one zip code, one prefix, or one range per rule. If you need to enter more than one of any, or a combination, you will have to make separate rules.

2. How much to charge:

a. Type of rate: Percentage or a flat rate

b. Specify the tax rate to be applied

c. Choose whether or not to tax shipping and handling charges

Note: If the shipping address meets the criteria for multiple tax rules, then the tax rate for all of those rules will be applied to the order.For example, if there is a tax rule for the state of MN, and another tax rule for zip code 55344, and the state is MN and the zip code is 55344 of the shipping address on the order, then both of the tax rules will be applied to the order.

Reference Material: none

Related Articles:

Navigate to Sales Tax Setup

Sales Tax Overview

Labels: Manage Tax Rules, Create Tax Rules, Tax, Sales Tax